Nudging with Care: How We Turned Re-KYC Into a 95% Success Story

Overview

Re-KYC Experience for PokerBaazi

Objective

PokerBaazi needed to comply with regulations requiring users to refresh their KYC every 2 years. However, more than 70% of users had expired KYC, and immediately blocking deposits/withdrawals would create frustration, churn, and distrust.

We designed a Re-KYC experience that balanced compliance with user emotions, using nudges, education, and color-coded urgency to guide users smoothly through the process.

Problem Statement

Regulatory Compliance: Re-KYC is mandatory after 2 years.

Business Risk: Blocking transactions immediately could lead to mass churn.

User Emotion: Fear of losing access to funds could trigger frustration.

We needed to design an experience that:

- Ensures compliance.

- Educates users early.

- Minimizes negative emotions.

- Drives smooth adoption of Re-KYC.

Strategy

Design Strategy

Progressive Nudge Escalation

🟡 Yellow (30 days) – Gentle awareness (“Your KYC will expire soon”) → educates without pressure.

🔴 Red (10 days) – Heightened urgency (“10 days left, avoid interruptions”) → shifts tone to action.

🔴 Alert GIF (24 hours) – Critical alert (“Update now to prevent disruptions”) → drives immediate resolution.

This design strategy mirrors natural emotional progression: awareness → consideration → urgency → action.

Human-Centered Compliance

Instead of treating Re-KYC as a regulatory chore, we designed it as a user-first experience. Our goal was to balance compliance with empathy — ensuring users felt guided, not penalized.

Emotional Safety Through Grace Periods

We deliberately avoided immediate restrictions (like blocking withdrawals or deposits).

Instead, we designed a 30-day grace window.

• Users remain stress-free → no sudden loss of trust.

• Nudges escalate gently → building urgency without triggering frustration.

• Users feel in control → they choose when to act within the safe period.

Emotional Journey

Journey Map — Re-KYC Nudges

The Emotional Journey Map helped us align nudges with user psychology.

By mapping emotions to visual states, we avoided creating sudden frustration (e.g., blocking withdrawals immediately) and instead guided users through a predictable, emotionally considerate journey.

This approach ensured compliance while maintaining trust, which is especially critical in a financial product like PokerBaazi.

Design

Visual Design

Our visual strategy focused on clarity, urgency, and emotional reassurance. Since compliance tasks can often feel intimidating, we used design to simplify and humanize the process.

Color-coded urgency:

Yellow indicated upcoming expiry, red showed critical urgency, and blinking red acted as the final alert — a progressive system that gently built awareness without overwhelming users.

Contextual nudges:

We placed reminders in high-traffic areas like the wallet screen, home screen, and KYC info page to ensure visibility without being intrusive.

Transparency through visuals:

Expiry dates, countdown timers were displayed prominently, helping users feel in control of the process.

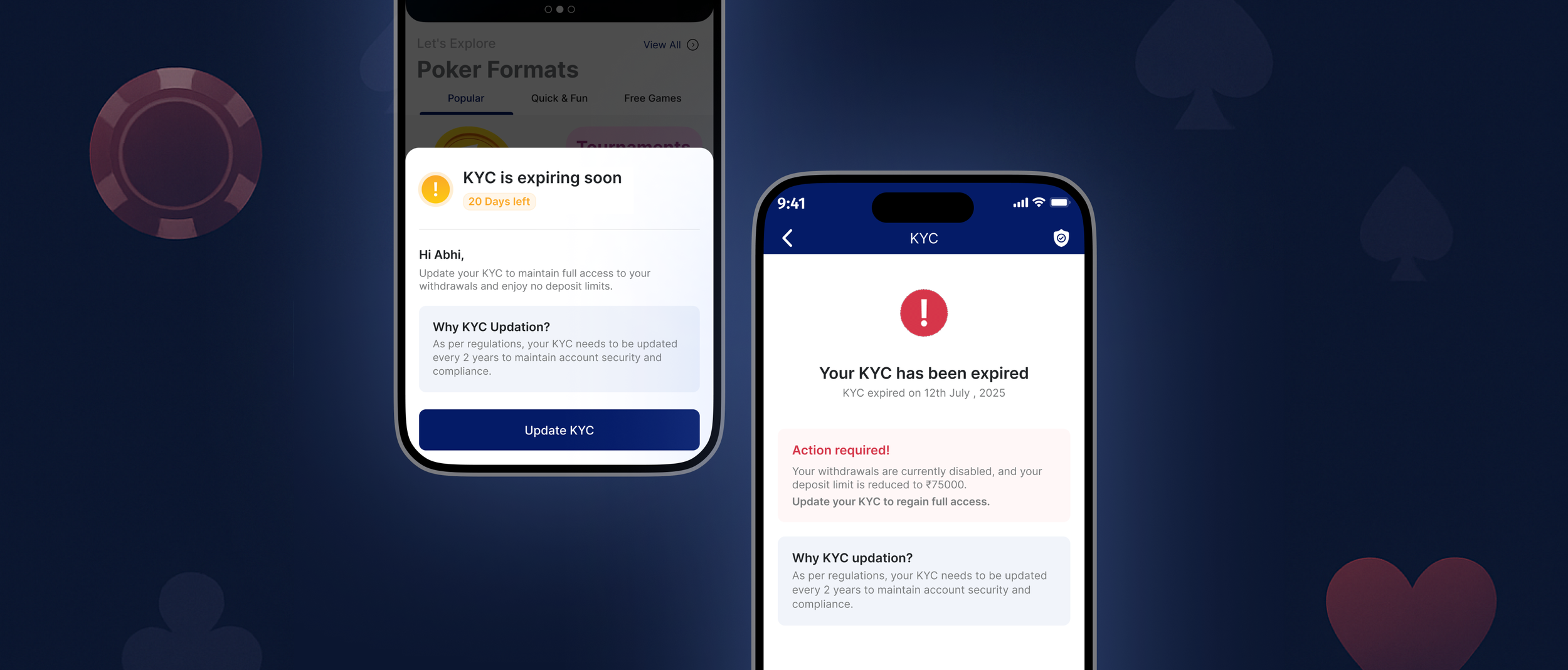

Bottom Sheet (20 Days Before Expiry,)

Personalized reminder with a short explainer on why Re-KYC matters.

Wallet Screen Widget

Small, high-visibility prompt with an info icon — always accessible on the most visited screen.

KYC Status Screen

Live status of user KYC , with education on consequences of inaction and why is it necessary.

Results

Outcomes & Success Metrics

95% Completion Rate: The majority of users completed re-KYC within the 30-day grace period.

High Engagement with Nudges: Click-through rates on nudges increased significantly as urgency levels (orange → red → blinking red) intensified.

Trust Maintained: By allowing deposits/withdrawals during the grace period, users did not feel penalized or frustrated, ensuring retention.

Compliance Achieved: A large portion of the user base is now fully compliant with updated KYC regulations.

Key Takeaways

This project demonstrates how regulatory compliance can be humanized through design.

Instead of treating Re-KYC as a bureaucratic task, we reframed it as a journey of awareness, urgency, and relief — balancing user emotions with business goals.

✨ The result? A trust-first, empathetic compliance experience that educates, nudges, and celebrates users along the way.